There are way too many Bitcoin FAQ's out there. Here are 6 interesting Bitcoin questions that no one has ever asked me.

Why do most Bitcoin services wait for 6 confirmations?

A transaction is confirmed every time a miner includes it in a block. Most exchanges and online wallets wait for 6 confirmations before they consider a transaction complete. They do this to protect themselves from double-spending, which is when a bad guy tries to spend the same bitcoin in two different places. Seeing one confirmation means a miner has submitted a block of transactions to the network, but what if that miner is the bad guy and the bad guy includes a double spend in that block? The more confirmations we wait for, the less likely it becomes that those miners are controlled by the bad guy trying to double-spend. 6 confirmations gives the wallet or exchange over 99.9% certainty that a double-spend did not occur.

Edit: Admittedly this is an over-simplification of double spending. You can read more about how doubles spending works here, and here.

Source: https://bitcoil.co.il/Doublespend.pdf

What is a transaction fee?

You can pay a transaction fee to get your transaction confirmed more quickly. Your transaction fee goes to the miner who first confirms the transaction. This provides an incentive to miners so they include your transaction in the next block.

Source: Bitcoin.it/wiki

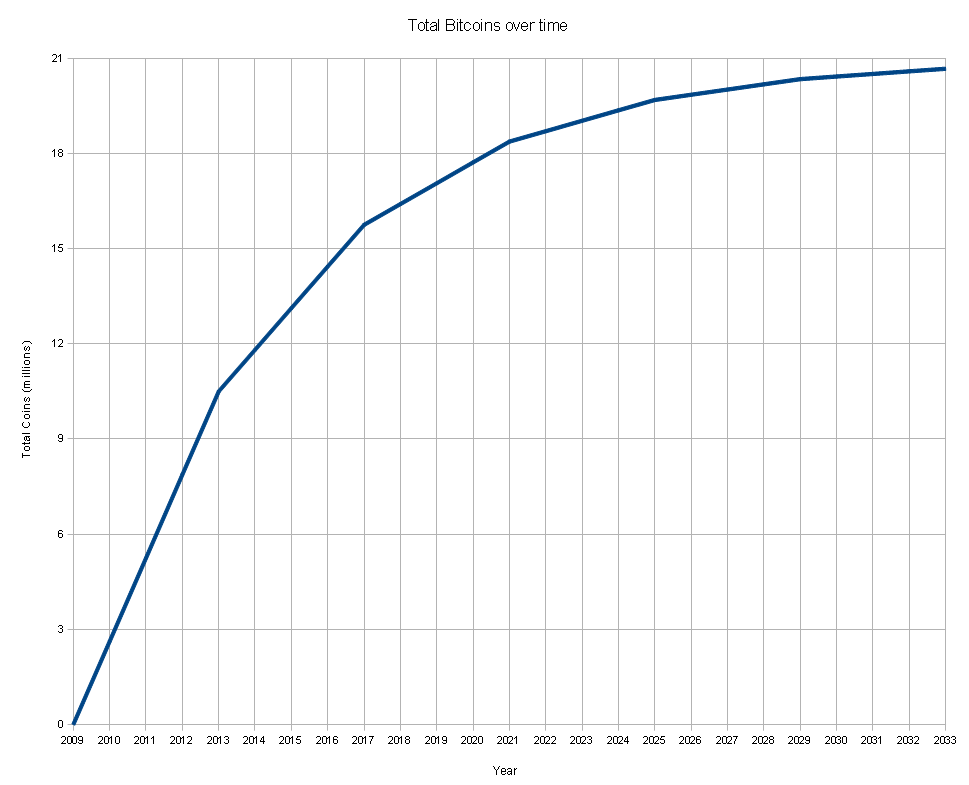

When will the last Bitcoin be mined?

The last of the 21 million bitcoins will be mined sometime in 2140, so most likely none of us will be around! This graph doesn't extend all the way out to 2140 but that is the intended finale if everything goes to Satoshi's plan.

The Bitcoin network self regulates by adjusting two variables: the amount of Bitcoin rewarded to miners (block reward), and how difficult it is for miners to find a block (difficulty factor). These two variables change to keep the rate of Bitcoin creation consistent with this graph. The Bitcoin network tries to have a block created every 10 minutes, which it does by adjusting the difficulty factor. The block reward started at 50 bitcoins and is cut in half every 210,000 blocks, or about every 4 years. From this we can extrapolate that the last bitcoin will be rewarded in 2140.

As it turns out, bitcoin mining is ahead of schedule because so far we have been mining a block every ~9 minutes instead of every 10. The world is developing mining tech more quickly than the bitcoin network can adjust the difficulty factor. This could put the last bitcoin somewhere around 2085.

What will happen when the last Bitcoin is mined?

Well, none of us will see this happen, but we can speculate. The best theory is that even though the miners won't receive any more block rewards, the transaction fees will be enough of an incentive to continue mining. If there aren't enough miners, transaction fees will be forced up, providing incentive for new miners to start confirming transactions.

Can a government shut down Bitcoin?

Since Bitcoin is decentralized, it would be very difficult for any government to stop Bitcoin completely. However, they could make Bitcoin illegal and very difficult to buy. This would drastically reduce the appeal of bitcoin to the more law-abiding citizens, and force it into the realm of drug dealers and anti-government factions.

A government could also start shutting down any businesses that deal with fiat currency and Bitcoin. Stopping exchanges, brokers and the companies that accept Bitcoin for products and services would make Bitcoin very hard to obtain or use. We might see a network of "Bitcoin dealers" who only do face-to-face deals in sketchy alleyways.

In the same way that governments have a difficult time stopping BitTorrent pirating, there isn't a practical way to stop all computers from mining and submitting transactions to the block chain. So even if Bitcoin becomes unappealing, illegal and difficult to use, it can still survive.

How many Bitcoins have been stolen?

We don't really know, but its at least 600,000 BTC.

Here is a list of the most significant bitcoin thefts. You can read about these over on Bitcoin Talk.

| Rank | Name | Time | Amount (BTC) |

| 1 | Bitcoin Savings and Trust | 2011–2012 | 263,024 |

| 2 | MyBitcoin Theft | July 2011 | 78,739 |

| 3 | Linode Hacks | March 2012 | 46,653 |

| 4 | July 2012 Bitcoinica Theft | July 2012 | 40,000 |

| 5 | May 2012 Bitcoinica Hack | May 2012 | 18,547 |

| 6 | Allinvain Theft | June 2011 | 25,000 |

| 7 | Tony Silk Road Scam | April 2012 | 30,000 |

| 8 | Bitfloor Theft | September 2012 | 24,086 |

| 9 | Bitomat.pl Loss | August 2011 | 17,000 |

| 10 | Bitcoin7 Hack | October 2011 | 11,000 |

| 11 | Cdecker Theft | September 2012 | 9,222 |

| 12 | Stefan Thomas Loss | June 2011 | 7,000 |

| 13 | BTC-E Hack | July 2012 | 4,500 |

| 14 | Mass MyBitcoin Thefts | June 2011 | 4,019 |

| 15 | Mooncoin Theft | September 2011 | 4,000 |

| 16 | Kronos Hack | ??? | 4,000 |

| 17 | 2012 Trojan | Sept-Nov 2012 | 3,500 |

| 18 | Betcoin Theft | April 2012 | 3,171 |

| 19 | June 2011 Mt. Gox Incident | June 2011 | 2,643 |

| 20 | October 2011 Mt. Gox Loss | October 2011 | 2,609 |

| 21 | Andrew Nollan Scam | February 2012 | 2,211 |

| 22 | Bit LC Theft | February 2013 | 2,000 |

| 23 | Bitcoin Syndicate Theft | July 2012 | 1,852 |

| 24 | Just Dice Incident | July 2013 | 1,300 |

| 25 | Ubitex Scam | ~2011 | 1,138 |

| 26 | Bitscalper Scam | ~2012 | 1,000 |

| 27 | 2013 Fork | March 2013 | 960 |

| 28 | Ozcoin Theft | April 2013 | 922 |

| 29 | BTCGuild Incident | March 2013 | 254 |

| Total | 610,356 BTC | ||

| Current Bitcoin Price | $97.68 | ||

| Value Today | $59,619,617 USD |

If you have any more questions, or would like other Bitcoin topics covered, feel free to tweet me at@rossrobinson, or send me an email at [email protected]. If you don’t own any bitcoins yet, check out our new project, Tinkercoin. It helps you get started in the Bitcoin world, buy your first bitcoins and start spending them in under fifteen minutes.

Once you understand the

Once you understand the

Gareth is sending these bitcoins to Eve, whose signature is this.

Gareth is sending these bitcoins to Eve, whose signature is this.

No matter what they tell you, Bitcoin is not like normal currency.

No matter what they tell you, Bitcoin is not like normal currency.